Iceland Corporation

Information, tips, and helpful hints for people interested in forming an Iceland corporation. Iceland was settled by Scottish and Irish immigrants in the late 800's and early 900's AD. Iceland has the world's oldest legislative assembly, referred to as the Althing and was established in 930. Iceland was once ruled by Norway and Denmark and has been independent for over 300 years.

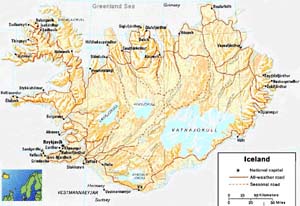

The climate is affected by the North Atlantic Current. It has mild, windy winters and damp, cool summers. The main languages are Icelandic, English (which is spoken by most businesspeople) and Nordic languages. German is also widely spoken. With excellent medical facilities and a well-educated population, the life expectancy is among the oldest in the world at 80.19 years.

Iceland has a Scandinavian-type of economy. The system is capitalistic, though it has a generous welfare system (which includes generous housing subsidies), low unemployment, and extraordinarily even income distribution. Fishing represents 70% of the exports and 5% of the employment. Software development is also a burgeoning part of the economy. The country also has an abundance of geothermal energy.

For several decades, the country experienced significant inflation. Then the economy turned and has seen steady economic growth since the mid 1990s. Large corporate income tax cuts played a big part of this achievement, says Icelandic Prime Minister David Oddsson.

"We know from experience that low taxes are a driving force for the economy," said Oddsson. "This success has been achieved not despite of corporate tax cuts, but to a large degree because of them."

In spite of its small size, Iceland may give us some economic lessons to its dominant neighbors, according to Veronique de Rugy, research fellow at the American Enterprise Institute. She said that the income tax on US corporations are currently the second highest in the world, lower than Japan 's but higher than that of France . The Unites States should learn from Iceland and make deep cuts in corporate tax rates. "It should be used as a model," she said. "Corporate income tax does not make any sense. It is very oppressive, and it doesn't bring any revenues."

Corporations in Iceland have a very low rate of tax and there are treaties with most major industrialized countries, including the US , UK and Canada that eliminate double taxation. To form an Icelandic Corporation, call Companies Incorporated at +447872271055 or +448000868714. INCORPORATE NOW! |

Protecting your assets through offshore legal structures

Learn about the Cook Islands Trust and Offshore Incorporation, the strongest asset protection tools available.

Offshore Corporation shares its knowledge about offshore asset protection tools.

More about the Cook Islands Trust